Current Rates

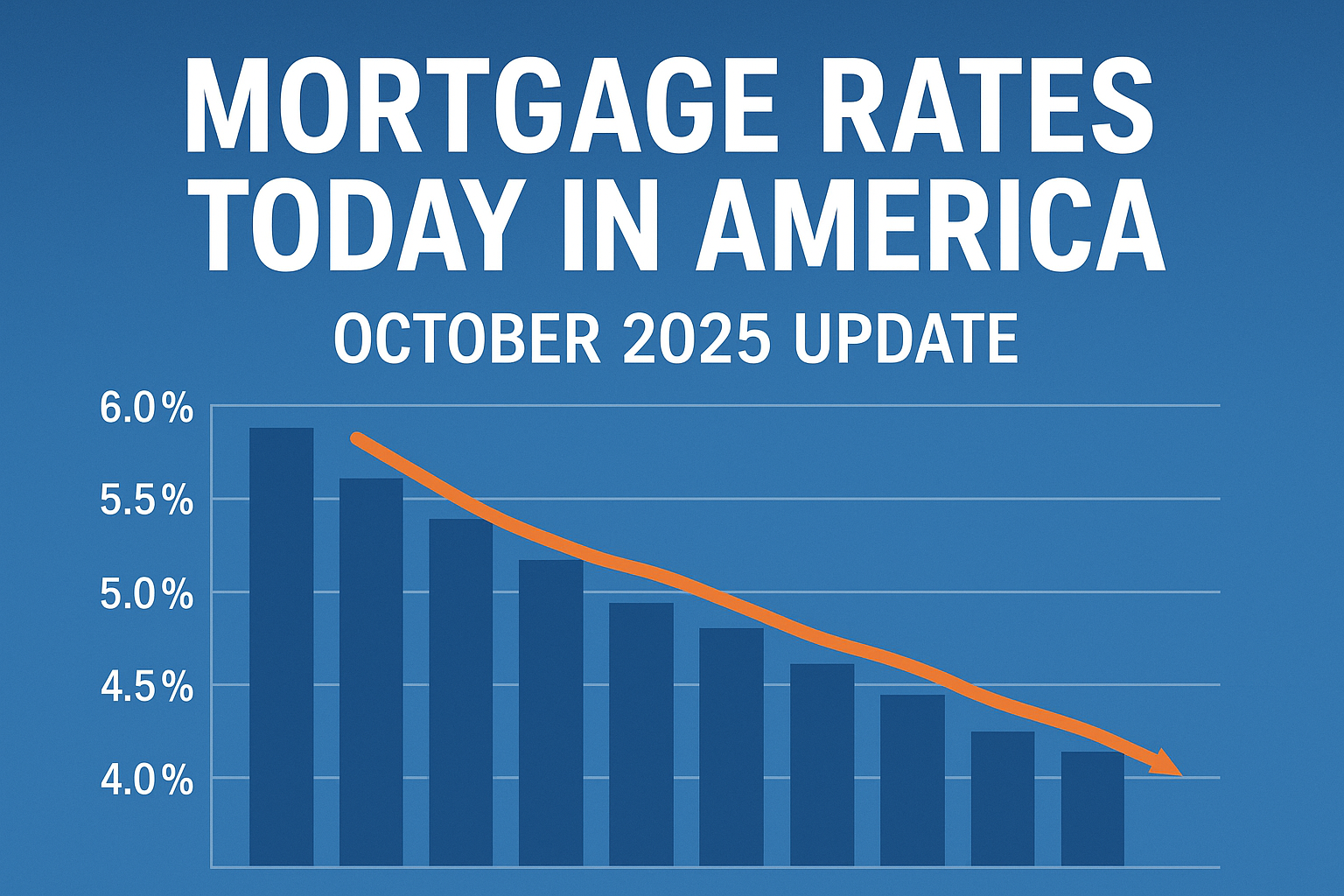

For homebuyers and refinancers in the U.S., the rate landscape has shifted notably. The average rate for a 30-year fixed mortgage is around 6.19%, down from around 6.54% a year ago. (Fast Company)

Some lender-surveys show it slightly higher or lower (e.g., ~6.26%) depending on credit, region and loan details. (Bankrate)

For 15-year fixed loans, rates are lower—around 5.44% in the latest surveys. (The Economic Times)

Importance

- At 6%+, the cost of borrowing remains high relative to the ultra-low rates of recent years—but this drop is meaningful for many buyers and refis.

- A rate drop of even 0.3-0.5 % can lower monthly payments by several hundred dollars on a typical U.S. home loan.

- The housing market is sensitive: when rates ease, purchase activity and refinancing often pick up. For instance, mortgage applications rose recently as rates eased. (Reuters)

Key Drivers of Rate Movement

Inflation And Economic Growth

When inflation falls or economic growth slows, lenders anticipate less pressure on the central bank and bond yields can decline—leading to lower mortgage rates. Latest inflation metrics and labour-market softness are helping. (Reuters)

Bond Yields (10-Year Treasury)

Mortgage rates tend to follow the yield on the 10-year Treasury note. When that yield drops, mortgage rates often follow. Recently, as the 10-year yield dipped below 4%, mortgage rates edged down. (ABC News)

Central Bank Policy

Although the Federal Reserve doesn’t set mortgage rates directly, its policy signals and rate decisions influence market expectations—and thus mortgage rates. A recent Fed rate cut increases expectation of lower rates ahead. (CBS News)

Market Sentiment And Housing Supply

Housing supply constraints, home-price trends, regional variations and borrowers’ credit profiles all play a role. Even if headline average rates drop, your actual offered rate may vary widely depending on your location, credit score, down-payment and loan type. (wellsfargo.com)

What Buyers And Refinancers Should Know

For New Home Buyers

- Lock early: Rates fluctuate daily; if you find a rate you’re comfortable with, locking it in can protect you.

- Shop lenders: Because rates vary by credit score, down payment and loan program, compare multiple offers.

- Understand total cost: Interest rate is one part—also consider closing costs, points, fees and the loan term.

- Don’t assume below 6% yet: Despite recent drops, many experts believe rates won’t fall far below 6% until later. (The Economic Times)

For Homeowners Considering Refinancing

- Check how much you’ll save: A rate drop of even 0.5% may or may not justify refinancing if fees are high.

- Break-even point matters: Calculate how many months until the refinance pays for itself.

- Loan‐to‐value, equity and credit score still matter: These determine whether you’re eligible for best refinancing rates.

- Consider lock-in time: If rates are still trending downward, some may wait—but that carries risk of reversal.

Things to Monitor

- Inflation reports: New data on CPI or PCE up or down will influence rates.

- Treasury yields: If yields climb, mortgage rates may also.

- Federal Reserve signals: Further cuts or surprises in policy may shift market expectations.

- Housing market supply & demand: A surge in homes for sale or dampened buyer demand could ease rates further; tight supply may keep rates elevated.

Outlook: What’s Next?

- Some economists believe that much of the “easy drop” in rates has already happened—meaning large further declines may be limited. (Fast Company)

- Forecasts suggest average 30-year fixed rates may drift downward to around 5.9%–6.4% by late 2026—but not dramatically below that unless there’s a major economic shock. (The Economic Times)

- That means for many borrowers: today’s rates may represent a good opportunity, especially if your personal situation is strong (good credit, stable income, enough down payment).

Conclusion

Mortgage rates today in America remain elevated compared to historical lows—but the recent drop toward ~6% for a 30-year fixed loan is a positive development for homebuyers and homeowners considering refinancing.

Key take-away: If you’re financially ready (credit, savings, income), it may be wise to act sooner rather than later—because while rates could fall further, the margin for big drops seems to be narrowing.

Be sure to compare lender offers, understand your full cost (not just the interest rate), and align your decision with your long-term home-ownership or refinance goals.

- Explore our guide: How to Lock a Mortgage Rate Effectively

- See our article on: Refinancing: When It Makes Financial Sense

- Latest survey from Freddie Mac: Freddie Mac Mortgage Rates (Freddie Mac)

- Mortgage rates commentary from Mortgage Bankers Association: MBA Weekly Survey (Reuters)